Warranty Expenses in the U.S. Truck, Bus, and Heavy Equipment Sector:

For the second consecutive year, the industry reported record-high warranty claims in 2024, even as both total accruals and reserves decreased compared to 2023. Notably, Paccar experienced a significant 45% increase in claim costs, following a nearly double rise in its warranty accruals the previous year.

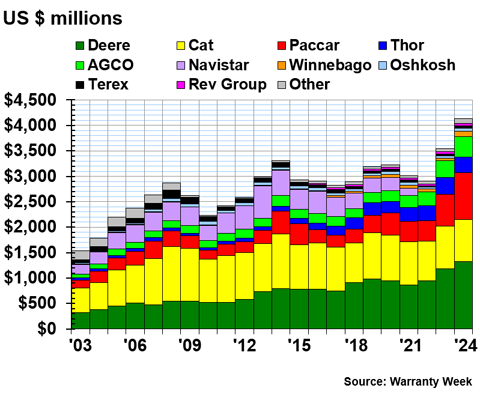

Recently, we showcased 22-year data on warranty expenses for the passenger vehicle sector, encompassing manufacturers of various large vehicle types, including pick-up trucks and ambulances. This edition focuses on warranty expenses incurred by U.S.-based truck, bus, and heavy equipment manufacturers, which represented about 12.5% of all reported product warranty costs in the United States for 2024.

The industry produces an extensive range of large vehicles, including agricultural, construction, and mining equipment, as well as on-highway trucks, recreational vehicles (RVs), and various types of buses such as coach, transit, and school buses.

It’s important to note that this category pertains solely to vehicle frame manufacturers, excluding tier 1 suppliers and powertrain manufacturers like Cummins and BorgWarner. The warranty processes for commercial vehicles differ from those for consumer vehicles since components such as engines and transmissions are often sold separately, with individual warranties for each part. It’s not unusual for different manufacturers to supply these components and warranties within a single vehicle. Future newsletters will cover warranty expenses for auto parts suppliers and their relationships with OEMs.

In 2024, 21 U.S.-based manufacturers reported warranty expenses, including well-known companies such as Deere & Co., Caterpillar Inc., and Paccar Inc. Of note, Manitex was acquired by Japan’s Tadano Ltd. in January 2025, marking 2024 as its final reporting year in the U.S. Additionally, Nikola Corp. filed for Chapter 11 bankruptcy in February 2025, possibly making 2024 its last data year. The company faced legal issues as its founder was sentenced to prison for investor fraud but was later pardoned following political donations.

Throughout the years 2003 to 2024, there were 36 manufacturers that reported warranty expenses, although only 21 did so in 2024. Among these, Proterra Inc. filed for bankruptcy in mid-2023, resulting in the sale of its electric transit bus line while its other assets were sold to various firms. Notably, Navistar was acquired by Traton SE in mid-2021 and has since been rebranded as International Motors.

This newsletter is grounded in comprehensive analysis of annual reports and quarterly financial statements from publicly traded U.S. manufacturers of trucks, buses, and heavy equipment. Key metrics collected include claims paid, accruals made, and warranty reserve balances. Additionally, we segmented revenues to determine warranty expense rates: claims rate (claims as a percentage of sales) and accrual rate (accruals as a percentage of sales).

Warranty Claims and Accruals Overview

In 2024, the industry paid a total of $4.128 billion in warranty claims—a 15% rise from 2023—and set a new record for the second consecutive year. Companies like Deere and Paccar reported notable increases in claims paid, with Paccar recording a $918 million figure, a substantial 45% rise. Conversely, total warranty accruals for 2024 reached $3.412 billion, down 19% from the previous year. Various manufacturers exhibited differing trends, with both increases and decreases in claims and accruals, indicating a complex landscape within the industry.