Market Uncertainty Influences Used Truck and Farm Equipment Sales, Yet Opportunities for Buyers Exist

LINCOLN, Nebraska — May 6, 2025. Recent reports from Sandhills Global regarding used trucks, trailers, and equipment highlight a market fraught with uncertainty while also showcasing accessible purchasing options for buyers.

In the realm of used agricultural equipment, TractorHouse Manager Ryan Dolezal stated, “Economic challenges and market fluctuations are significant concerns. Nevertheless, this environment also offers buyers the chance to acquire equipment at more attractive prices. We expect the market to contract and later stabilize akin to the conditions seen between 2017 and 2019.”

On the subject of the used truck and trailer sector, Truck Paper Manager Scott Lubischer remarked, “Sales for new trucks have plateaued, with buyers delaying purchases until 2026. OEMs have responded by reducing production. Amid ongoing economic uncertainty, many buyers are hesitating; however, inventory is stable, and transactions continue.”

Central to all of Sandhills’ market assessments is the Sandhills Equipment Value Index (EVI), which provides buyers and sellers with data to track equipment markets and optimize their decisions regarding acquisitions, sales, and overall business strategies. The EVI covers equipment listed in both auction and retail formats, as well as model-year equipment currently deployed, measuring the percentage difference between asking and auction prices.

Key Insights from Market Reports

The Sandhills market reports detail notable shifts within the used heavy-duty truck, semi-trailer, agricultural machinery, and construction equipment sectors. Below are key highlights from the latest reports; comprehensive reports can be requested.

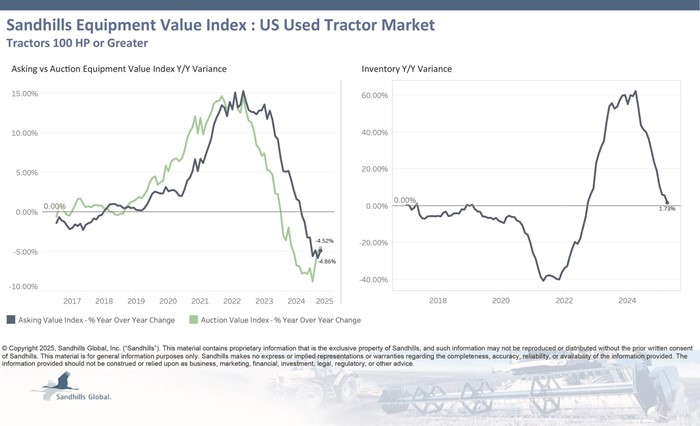

Used Tractors Over 100 Horsepower

Inventory in this category saw a slight decrease of 2.3% month-over-month but a 1.73% increase year-over-year in April. The 100- to 174-horsepower tractors saw the most significant month-over-month drop at 2.51%, while high-horsepower tractors (300 HP and above) experienced the greatest year-over-year rise at 7.1%. Asking prices increased by 0.73% month-over-month but fell by 4.86% year-over-year, illustrating an overall downward trend.

Used Combines

Inventory levels for used combine harvesters rose by 0.53% month-over-month but were down by 5.43% compared to the previous year. Asking prices experienced a modest uptick of 0.22% month-over-month but a decline of 2.06% year-over-year. Auction values continued to rise, going up by 1.31% month-over-month and 2.21% year-over-year in April.

Used Sprayers

Inventory levels for used sprayers fell by 3.69% month-over-month and 1.81% year-over-year in April. Asking values decreased by 1.88% month-over-month and 4.41% year-over-year, indicating a downward trend. Auction prices also diminished, dropping by 3.71% month-over-month while maintaining an overall upward trajectory.

Used Heavy-Duty Trucks

Inventory of used heavy-duty trucks exhibited a 3.75% increase month-over-month but a notable 23.05% decrease year-over-year in April. Asking values were relatively stable, slightly rising by 0.21% month-over-month but decreasing by 3.16% year-over-year. Auction values changed minimally, increasing by 1.57% month-over-month but decreasing by 2.2% year-over-year.

Access Complete Reports

For further insights or to acquire detailed analyses from Sandhills Global, please reach out at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) serves as a primary indicator of estimated market values for used assets across the construction, agriculture, and commercial trucking sectors, as represented by Sandhills Global marketplaces. The EVI, supported by Sandhills’ proprietary Value Insight Portal (VIP), provides valuable insights into shifting supply-and-demand dynamics in each industry.