New FMCSA Alert System for Brokers and Carriers

In early November, the FMCSA implemented a new alert system targeting brokers, forwarders, and motor carriers whose surety bonds or insurance are slated for cancellation by their providers.

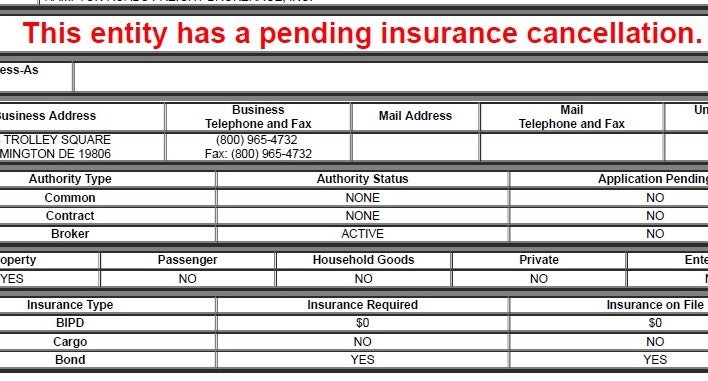

Purpose of the Alert

Representatives from FMCSA’s Licensing and Insurance division explain that the intention behind this notice is to inform the public engaged with these regulated entities that an insurance company or financial institution has filed a pending cancellation of the entity’s policy. This notice remains active until the updated filing’s effective date or until the authority is revoked due to non-compliance with insurance requirements.

Impact on Identifying Fraudulent Brokers

Marold Studesville, President of Transport Financial Services (TFS), highlights that this new alert will assist carriers in identifying fraudulent brokers who exploit a gap period of 30-60 days, which can exist between the initial bond claim and FMCSA’s ultimate authority revocation. This loophole was discussed in a previous article focused on significant fraud cases in the brokerage sector.

Visibility on Safer.gov

The warning appears on the FMCSA Licensing and Insurance detail page for each broker. Moreover, each broker or forwarder’s page on Safer.gov, a widely utilized platform for shippers and carriers, also has a link directing users to check their insurance via the FMCSA’s resources.

A Step Towards Enhanced Verification

Studesville views the new alert and accompanying link as a technological means of cautioning both carriers and shippers prior to deciding to engage with a broker. This alert is aimed at curtailing dishonest practices, especially in light of past instances where brokers accrued significant claims after notifications of cancellation.

Further Regulatory Actions

The FMCSA is also considering regulatory amendments to eliminate the time-lag loophole, prompted by the “immediate suspension” authority outlined in 2012 legislation. Studesville believes these technological fixes could significantly reduce claims in the long run.

The Call for Industry Vigilance

While Studesville’s approach to cancellation may be more proactive than others, he emphasizes the need for vigilance among carriers. He urges them to pay attention to insurance-status alerts and check with brokers or bond providers before engaging in business transactions, ultimately contributing to a decline in fraudulent activity within the industry.