Market Overview for Used Agricultural Equipment

According to TractorHouse Manager Ryan Dolezal, the used agricultural equipment market is currently facing economic pressures and market fluctuations. Despite these challenges, there are opportunities for buyers to find equipment at better prices. Dolezal expects the market to contract and stabilize, resembling trends noted between 2017 and 2019.

Insights on Used Trucks and Trailers

Truck Paper Manager Scott Lubischer reports that sales of new trucks remain flat, pushing pre-buy behavior from 2025 to 2026. To counteract this, OEMs are reducing production. Amidst uncertainty in the global economy, buyers are hesitant, yet inventory levels remain steady, and transactions continue to occur.

Sandhills Equipment Value Index (EVI)

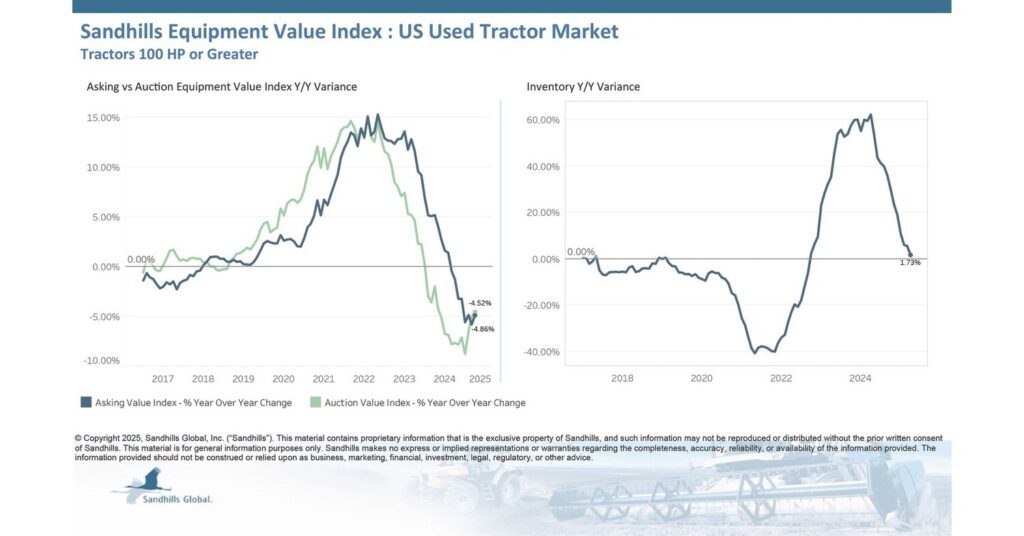

The Sandhills Equipment Value Index (EVI) is a crucial metric in market reporting. It provides valuable insights for buyers and sellers, helping them make informed decisions on acquisitions, liquidations, and business strategies. The EVI data covers equipment available in auction and retail markets and includes active model-year equipment. The EVI spread indicates the percentage difference between asking and auction prices.

Key Market Trends

Recent reports from Sandhills reveal significant shifts in various categories, including used heavy-duty trucks, semi-trailers, farm machinery, and construction equipment. Highlights from the current reports are outlined below, with full reports available upon request.

U.S. Used Tractors Over 100 Horsepower

Inventory levels in this market saw minimal fluctuations, dipping by 2.3% month-to-month (M/M) but rising 1.73% year-over-year (YOY) in April. The used 100- to 174-horsepower category faced a notable M/M decrease of 2.51%, while high-horsepower tractors (300-plus HP) grew by 7.1% YOY. Asking prices rose slightly M/M by 0.73% but declined 4.86% YOY. Auction values also saw a slight M/M decrease of 0.02% and a 4.52% YOY drop, albeit with an overall upward trend.

U.S. Used Heavy-Duty Trucks

In April, U.S. used heavy-duty truck inventory was stable, showing a 3.75% M/M increase, yet a significant 23.05% YOY drop. Asking values remained steady, nudging up by 0.21% M/M but down 3.16% YOY. Auction values showed minimal changes, increasing by 1.57% M/M while decreasing by 2.2% YOY.

Contact for Further Information

For more detailed analysis from Sandhills Global, please reach out to us at [email protected]. Sandhills Global, headquartered in Lincoln, Nebraska, specializes in processing and disseminating information across various industries, including agriculture, construction, and trucking.