Market Overview

“The truck market is currently shrouded in uncertainty,” remarks Truck Paper Manager Scott Lubischer. “Dealers are offloading trucks not necessarily due to upgrades, but because operational needs persist. They are cutting prices to stimulate sales but are encountering challenges from reduced port activity, falling freight volumes, and tariffs.”

Used Heavy- and Medium-Duty Equipment Trends

In the heavy- and medium-duty used construction equipment sectors, Sandhills reports a downward trend in inventory, despite minor monthly increases observed in May. Asking prices and auction values have decreased across all used construction equipment markets. While trend lines have remained stable, consistent value declines may lead to downward shifts in these lines.

Mixed Market Dynamics

“Used equipment dealers are facing a varied market,” explains Stephanie Olberding, Director of North America Construction. “Seasonal demand fluctuations have contributed to the slight increases in heavy-duty construction inventory seen in the May reports.”

Key Indicator: Sandhills Equipment Value Index (EVI)

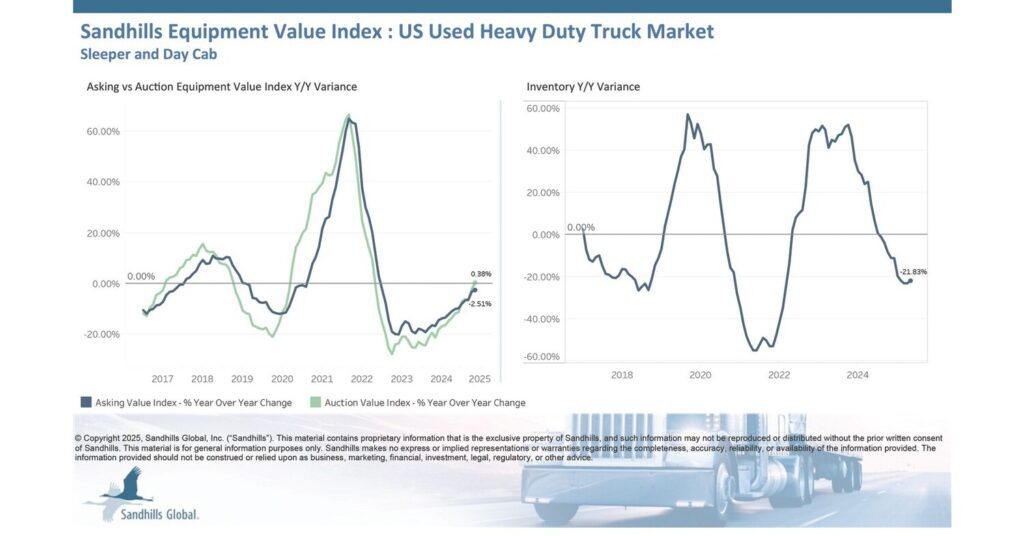

The Sandhills Equipment Value Index (EVI) is a crucial metric in Sandhills’ reports. It helps buyers and sellers gauge equipment market dynamics and optimize their acquisition and liquidation decisions. The EVI data includes equipment available in auction and retail markets, as well as model-year equipment currently in use. The EVI spread reflects the percentage difference between asking and auction values.

Market Insights Snapshot

Sandhills’ market reports identify the most noteworthy shifts in the used heavy-duty truck, semi-trailer, farm machinery, and construction equipment sectors. Key findings from the latest reports are summarized below and full reports can be requested.

Heavy-Duty Trucks Analysis

U.S. inventory levels for heavy-duty trucks increased by 3.9% month-over-month in May but decreased by 21.83% year-over-year, maintaining a steady trend. Used sleeper trucks saw a 6.38% month-over-month inventory rise but a significant 35.37% year-over-year drop. Asking prices have been stable with a 0.19% increase month-over-month and a 2.51% decrease year-over-year in May, with sleeper trucks seeing the largest month-over-month increase at 1.29%.

Used Medium-Duty Trucks Update

In the medium-duty trucks sector, inventory levels increased by 1.83% month-over-month and 25.79% year-over-year in May. Despite this, asking and auction values have been declining for nine months, with month-over-month decreases of 0.97% and 0.55%, respectively. The used moving box trucks category had the highest inventory increase while the used stake truck category experienced the most significant decline in asking and auction values.

Full Reports and Company Background

For detailed insights, access full reports from Sandhills Global by reaching out at [email protected]. Sandhills Global, headquartered in Lincoln, Nebraska, specializes in information processing across various industries, including construction and agriculture, providing platforms that connect buyers and sellers. The Sandhills Equipment Value Index measures market values of used assets within these sectors and offers real-time insights into market conditions.