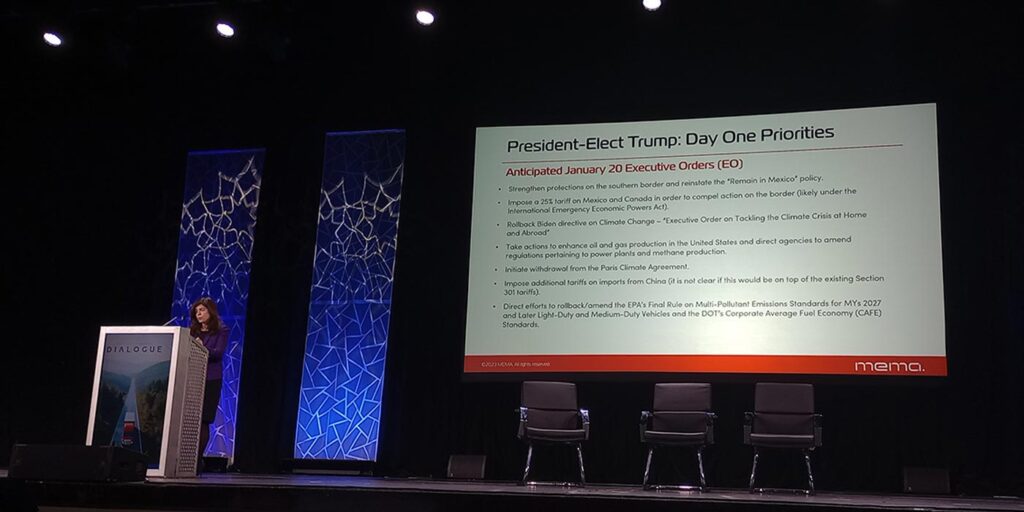

Shortly after President Trump’s inauguration, Ana Meuwissen, MEMA’s senior vice president for government affairs, took the stage at the Heavy Duty Aftermarket Dialogue to address how potential executive orders from Trump might affect the trucking aftermarket.

Concerns Over Tariffs and Supply Chain Strains

One of the primary issues facing the trucking aftermarket is the administration’s position on tariffs. Although the president has shown support for new tariffs, early actions suggest a methodical approach. This may involve directing federal agencies to investigate trade deficits and unfair practices instead of immediately enacting new tariffs. Nevertheless, the proposed 25% tariffs on imports from Mexico and Canada remain a significant concern.

This uncertainty poses immediate challenges for heavy-duty truck suppliers regarding the costs of aftermarket parts sourced abroad. Meuwissen highlighted, “Congress retains the constitutional authority to impose duties and tariffs. However, over the years, much of this power has been delegated to the Oval Office.”

The trucking sector has already begun to feel the ramifications of tariffs, particularly with Sections 301 and 232, which have previously driven up the prices of raw materials and components. If new tariffs are enforced, parts distributors may see costs rise, resulting in increased maintenance expenses for fleet operators.

“We have learned this morning about an imminent executive memorandum that will instruct federal agencies to investigate and tackle trade deficits and the unfair trading practices of other countries,” Meuwissen noted.

Regulatory Adjustments: Freezes and Revisions Ahead

Meuwissen indicated that President Trump intends to implement a regulatory freeze to suspend the rules in development under the Biden administration. This will impact a range of pending regulations, particularly the EPA’s Phase 3 greenhouse gas standards for heavy-duty trucks and the NOx emissions rule set for enforcement in 2027. The administration may also consider delaying or revising these regulations, which could affect compliance strategies for fleets and aftermarket suppliers.

A significant shift in regulations may come from the administration’s approach to California Air Resources Board (CARB) mandates. Trump has indicated plans to revoke the waivers previously granted to California for its Advanced Clean Fleets and Advanced Clean Trucks regulations.

Revisions to Tax Policy and Industry Incentives

The administration is also contemplating changes to the 2017 Tax Cuts and Jobs Act, focusing on possibly extending and lowering the corporate tax rate. While this may ease financial strains for trucking companies, the method of funding these cuts remains uncertain. One proposal includes rescinding certain provisions from the Inflation Reduction Act, which could diminish incentives for investment in electrification and alternative fuels.

MEMA has expressed concerns about the potential effects of these tax revisions on suppliers, particularly those who are investing in emission compliance and sustainability initiatives. “Committees are currently compiling a list of items that can be used to finance these tax incentives,” according to Meuwissen. “This list includes the repeal of several programs enacted under the Inflation Reduction Act, along with expected revenue from new and existing tariffs.”

The Future of USMCA and North American Trade

The United States-Mexico-Canada Agreement (USMCA) remains a central topic for the administration, set for a mandatory review in 2026. Various factions within the administration and Congress see this as an opportunity to renegotiate stricter regional content requirements for vehicles and parts. Trucking suppliers with cross-border manufacturing operations should prepare for possible changes that could elevate production costs and disrupt supply chains.

What’s Next for the Trucking Aftermarket?

The potential rollback of emissions standards may offer short-term relief from compliance costs while simultaneously hindering investment in next-generation trucking technologies. Additionally, tariffs and adjustments to trade agreements could create fresh cost pressures affecting aftermarket pricing and availability. Meuwissen emphasized that MEMA is actively engaging with policymakers to ensure the concerns of the trucking aftermarket are heard. As policies change, both fleets and suppliers must remain vigilant and ready to adapt to the evolving landscape.