Florida Set to Implement Law Against Exploitative Truck Towing

After passing a new bill in both the Florida House and Senate, it seems the governor is ready to sign it into law addressing predatory towing fees targeting trucking firms. A Senate staff member indicated confidence that the bill will receive approval, stating, “We haven’t heard anything to the contrary.” Once signed by Gov. Ron DeSantis, the law is set to take effect on July 1.

As reported by FreightWaves’ John Gallagher, the Florida Trucking Association (FTA) stipulates that towing and storage operators must produce and publicly display a fee schedule outlining all charges for vehicle recovery, which must be made available to vehicle owners, lienholders, and insurance firms upon request. Further, wrecker services are obligated to give this rate information to vehicle owners or operators before towing a vehicle. Rates exceeding the published ones may be deemed unreasonable.

This legislative initiative follows a November report by the American Transportation Research Institute, which surfaced several instances of exploitative towing fees linked to substantial truck accidents. Gallagher mentions that the research illustrated that excessive rates and unjustified extra service charges were the most prevalent types of predatory towing, reported by 82.7% and 81.8% of surveyed motor carriers, respectively.

Interview Highlights Focus on Driver Health and Industry Insights

In a recent episode of the ‘Taking the Hire Road’ podcast, Jeremy Reymer interviewed Michael Lombard, the president of Lombard Trucking. They discussed various topics, including the health of drivers, Lombard’s journey as a CDL driver, and his role as a driver influencer. As reported by FreightWaves’ Ashley Coker Prince, Lombard comes from a long lineage in trucking, dating back to his great-great-grandfather who began in the early 1900s. Despite setbacks like the Motor Carrier Act of 1980, he continues to carry on the family legacy.

Although Lombard initially didn’t aim to become a driver, he obtained his CDL post-Marine Corps service and began sharing his experiences online. He emphasized the significance of maintaining a healthy lifestyle while on the road, advocating for driver health after receiving feedback from fellow drivers.

As trucking fleets face increased operational costs, the health and welfare of long-haul drivers are under greater scrutiny. Lombard noted, “The driver’s lifestyle can reduce life expectancy by over 10 years,” with elevated risks of chronic illnesses. A study on health inequalities for long-haul drivers identifies these significant risks, urging that immediate preventive actions are necessary to address them, which could consequently affect the trucking industry and road safety.

February Market Update: LMI Transportation and Price Indexes Rise

The Logistics Managers’ Index released its February report on Tuesday, revealing an increase of 0.9 points from January’s 55.6 to a current reading of 56.5 points. This rise marks the highest level seen over the past year, with transportation developments and inventory growth at manufacturing and wholesale sectors contributing to this trend.

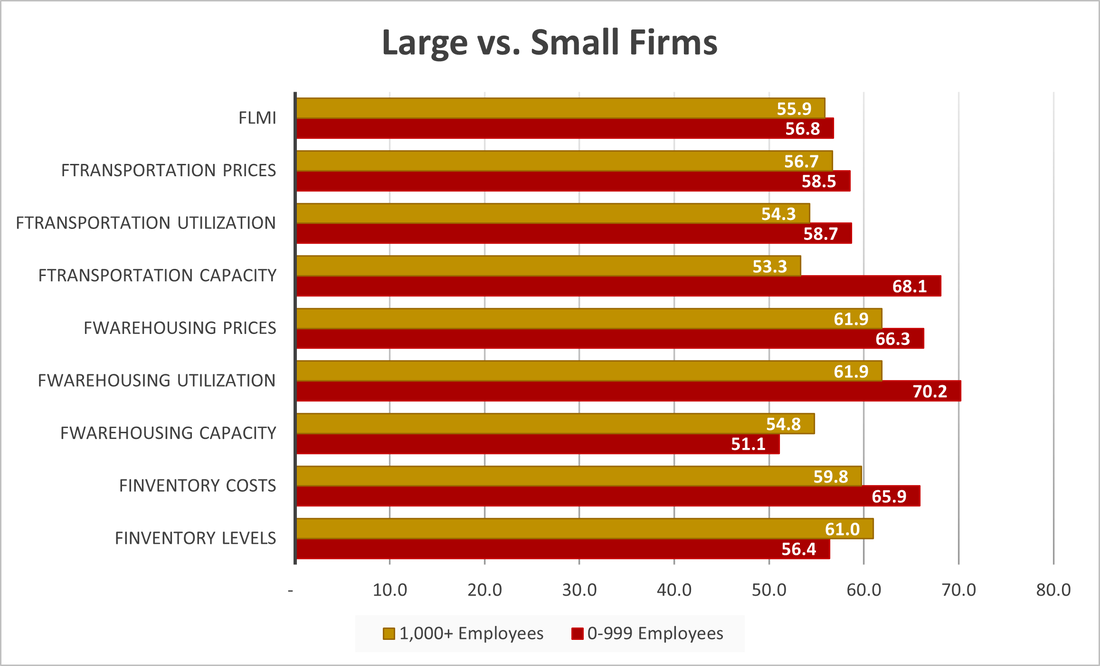

The report highlights that surplus transportation capacity continues to impede recovery in the freight market. Although the Transportation Capacity Index rose 6.4 points to 60.9 in February, this uptick favors smaller fleets. Notably, larger firms (1,000+ employees) experienced tighter capacity, yielding a growth rate of only 53.3, compared to 68.1 for smaller fleets. This divergence may highlight challenges within long-haul operations compared to regional shipping.

In examining truckload demand, the report points out that upstream movements are expanding faster than downstream ones. Upstream firms like wholesalers showed a stronger pricing indication at 60.9 compared to downstream firms like retailers at 52.7. The overall transportation pricing subindex decelerated throughout February, dropping from 62 in the first two weeks to 52.4 in the latter half.

FreightWaves SONAR Spotlight: Spot Rate Declines Halt

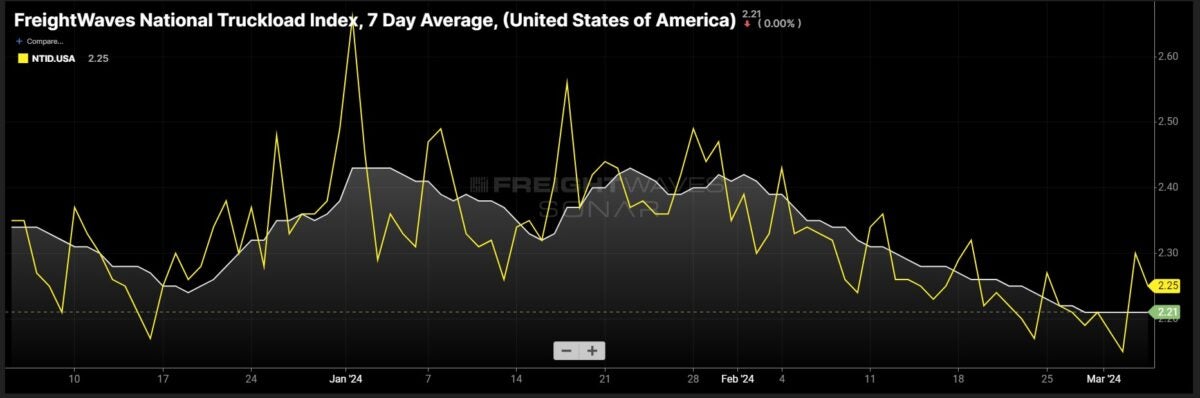

In summary, the gradual decrease in spot market rates that began in early February has now paused as of the first week in March, per the FreightWaves National Truckload Index 7-Day Average (NTI). Recent fluctuations upward in the NTI Daily (NTID) have contributed to this stabilization in spot market rates. Over the past week, overall spot rates dipped by just 1 cent per mile, settling at $2.21, with line-haul rates remaining unchanged week-over-week at $1.59 per mile when excluding fuel surcharges. The post-holiday surge in spot rates, extended by severe winter weather in January, seems to have concluded, with excess trucking capacity remaining a critical obstacle to a prolonged resurgence in spot market rates.

Additionally, decreasing outbound tender rejection rates coupled with improving outbound tender volumes indicate that shippers with better load compliance may not feel the need to shift surplus contracted freight to the spot market. Attention is also warranted on whether shippers will need extra support for spring projects and special freight or if their routing guides, equipped with ample capacity, can manage increased volumes. With ample transportation capacity in relation to demand, shippers retain various options as the freight market maintains its downcycle.

The Routing Guide: Noteworthy Links

ACF drives minor advancements in zero-emission drayage trucks at the Port of Long Beach (FreightWaves)

Is the rate roller coaster getting ready to shift? (FreightWaves)

Dispute over ESG policies results in the departure of a director at Werner (FreightWaves)

A truck driver sentenced for stealing a rig transporting Mike’s Hard Lemonade (FreightWaves)

A TSA regulation change offers relief to air logistics providers (FreightWaves)

Cummins CEO advances the company after record civil emissions fines (FreightWaves)