Heavy Duty Aftermarket Dialogue has closely examined the trucking aftermarket’s dynamics, highlighting trends in parts pricing, supply chain difficulties, and e-commerce insights shared by Dave Kalvelage, a client consultant and senior market analyst at MacKay & Company. Here are the key insights from MacKay & Company’s aftermarket survey.

Ongoing Issues: Pricing, Labor, and Parts Supply

In 2024, fleets and distributors consistently identified three main challenges: pricing, labor shortages, and parts availability. Fleets emphasized the importance of cost management, while distributors grappled with sourcing parts from suppliers and a lack of skilled workforce. Survey results from over 400 parts distributors revealed that 38% cited parts availability as their foremost concern, followed by pricing pressures and the demand for higher-quality aftermarket parts to keep trucks operational.

E-commerce Trends and Supplier Changes

The trend towards online parts purchasing continues to rise, although the landscape is shifting. Truck and trailer manufacturers and dealers now account for over 40% of online orders, leading to a decline in market share for heavy-duty distributors. Furthermore, nearly half of the distributors (47%) changed suppliers in 2024 due to availability challenges, while 40% did so because of price hikes, indicating a need for strategic procurement amid a fluctuating supply chain.

Inventory Practices and Pre-buying Habits

Some fleets and distributors have stuck to conventional inventory replenishment practices, while a third have reduced their stock in 2024, motivated by economic concerns or the need to manage excess inventory from the pandemic. Pre-buying in anticipation of potential 2027 GHG regulations and tariffs has been minimal, with only 11% to 16% of distributors and fleets making advance purchases.

Market Performance: A Varied 2024

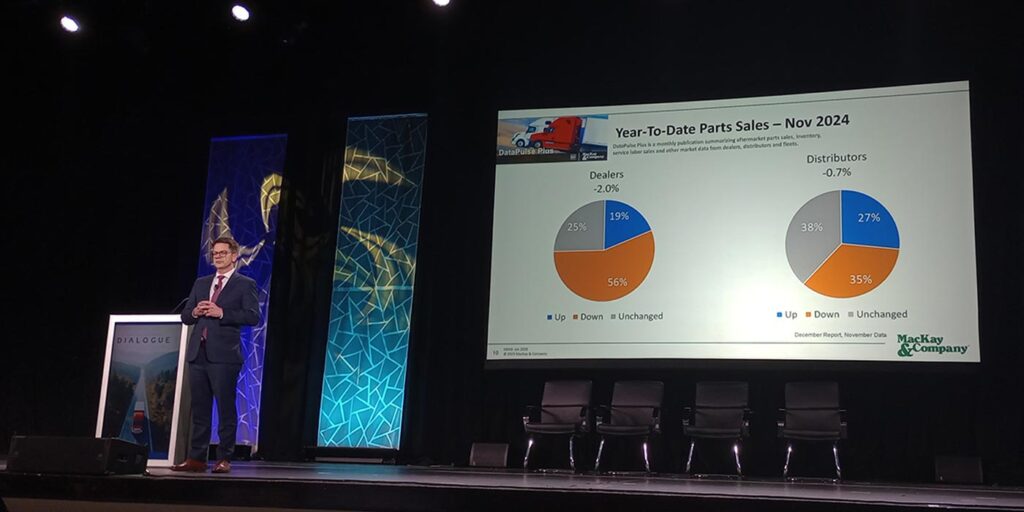

Kalvelage noted that there was a slight decline in trucking aftermarket sales in 2024:

- Dealers reported a drop of ~2%;

- Distributors faced a ~5% decrease;

- The aftermarket index decreased ~2% in the U.S. and nearly 5% in Canada;

- Mexico’s aftermarket stood out, growing over 4%.

Retail sales for trucks and trailers also fell in the U.S. and Canada, but Mexico saw double-digit growth across vehicle categories.

Utilization Rates and Pricing Stabilization

Utilization rates for Class 6–8 trucks slightly decreased to 84.2%, while trailer utilization fell more significantly to 86.3%. Fleets anticipate further reductions; however, analysts forecast stabilization with flat to slightly lower utilization in 2025.

After several years of volatile pricing, the market is now stabilizing, according to Kalvelage. While there was a post-pandemic price increase exceeding 10%, 2024 registered a more modest rise of 2.5%, with projections for 2025 suggesting a steady growth rate of 2%.

2025 Outlook: Potential Growth Ahead?

Despite the challenges of 2024, early signs indicate a modest recovery in 2025:

- The U.S. aftermarket is anticipated to grow by 3.9%, reaching $52 billion (including a 2% pricing increase).

- Canada’s market is expected to see a 1.8% increase in 2025, averaging annual growth at 2.8%.

- Mexico’s aftermarket is projected to rise by 3.1% in 2025.

Kalvelage attributes part of this growth to an increase in vehicle populations, especially in the Class 8 segment, predicted to grow nearly 9% over the next five years.

Implications for Fleet Management

- Parts availability is a critical issue—forge strong supplier relationships and diversify sourcing methods.

- E-commerce trends are favoring manufacturers and dealers—adapt procurement strategies accordingly.

- Inventory is stabilizing, though pre-buying remains cautious—watch for changes in tariffs and regulations.

- Utilization rates may not change much, but maintaining efficiency is vital for cost management.

- Growth in the aftermarket is anticipated, yet economic and regulatory uncertainties remain—flexibility will be crucial in 2025.

Although forecasting is inherently uncertain, Kalvelage highlighted that the aftermarket appears to be heading towards stability and gradual improvement as we approach 2025.