Ongoing Economic Uncertainty as Inventory Levels Increase in Truck and Construction Equipment Markets

LINCOLN, Nebraska — June 4, 2025. Recent reports from Sandhills Global indicate a month-over-month rise in inventory levels for the U.S. markets of used trucks, semi-trailers, and construction equipment on platforms like TruckPaper.com and MachineryTrader.com. While inventory levels of used heavy-duty trucks and semi-trailers remain stable despite monthly increases, used medium-duty truck inventories are experiencing a continuous upward trend, although their asking and auction values are declining.

Scott Lubischer, Manager at Truck Paper, stated, “The truck market is facing a lot of uncertainty. Dealers are parting with trucks not due to upgrades but because there is a continual need for operation. They are reducing prices to encourage sales but are feeling the impact of decreased port activities, lower freight volumes, and tariffs.”

In the used heavy- and medium-duty construction equipment sectors, Sandhills has noted a downward trend in inventory levels, even though there were slight monthly increases in May. Asking prices and auction values have also seen a decline across all used construction equipment markets. While trend lines are currently steady, a sustained drop in values could lead to downward shifts.

Stephanie Olberding, Director of North America Construction, remarked, “Used equipment dealers are working through a mixed-market environment. Seasonal declines in demand have contributed to the minor increases in heavy-duty construction inventory noted in the May reports.”

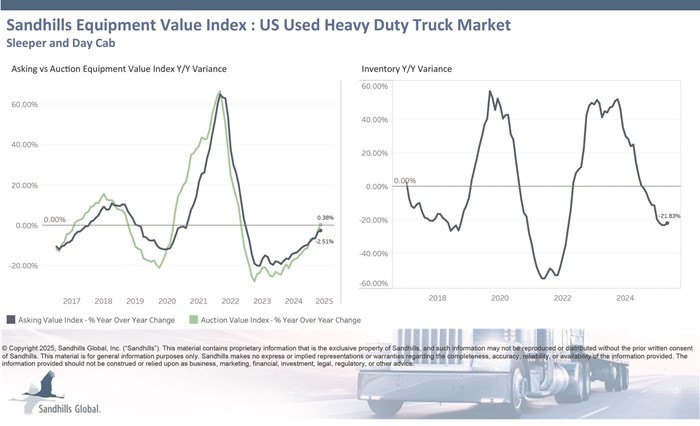

A vital metric in Sandhills’ market evaluations is the Sandhills Equipment Value Index (EVI). This index helps buyers and sellers track equipment markets and optimize outcomes regarding acquisition, disposal, and related business actions. EVI data include equipment available in auction and retail markets and model-year equipment actively used. The EVI spread assesses the percentage difference between asking prices and auction values.

Key Insights from the Market Report

The Sandhills market reports summarize significant shifts in the markets for used heavy-duty trucks, semi-trailers, agricultural equipment, and construction machinery. Essential highlights from the latest reports are detailed below, with full reports accessible upon request.

U.S. Heavy-Duty Trucks

Inventory levels in this segment grew by 3.9% month-over-month in May, although it saw a 21.83% year-over-year decline, maintaining an overall stable trend. The used sleeper trucks category witnessed the highest inventory fluctuations, with a 6.38% monthly rise and a significant 35.37% annual drop. Asking values have remained constant with a minor 0.19% monthly increase but a 2.51% annual decrease in May. The largest asking value jump was 1.29% in the used sleeper truck category.

U.S. Used Semi-Trailers

Inventory in the U.S. used semi-trailer market has remained stable, with a 3.41% month-over-month increase in May, although it was 11.2% lower than the previous year. The used reefer trailers saw the most significant monthly inventory growth at 10.49%. Despite asking values rising by 0.91% month-over-month, they dropped by 2.92% year-over-year, led by a 6.31% spike in used reefer trailers.

U.S. Used Medium-Duty Trucks

The inventory of used medium-duty trucks is showing a solid upward trajectory, up 1.83% month-over-month and 25.79% year-over-year. The used moving box truck category achieved the largest month-over-month increase at 19.51%. However, both asking and auction values have seen declines for nine consecutive months, reflecting a downturn in this sector.

U.S. Used Heavy-Duty Construction Equipment

Heavy-duty construction equipment inventory has been on a downward trend for five months, with a slight 1.23% increase in May, but still down 2.52% compared to last year. Despite slight monthly price drops, the auction values continued to trend sideways.

Additional Equipment Markets

Inventory levels in several equipment markets—including used compact tractors and sprayers—are experiencing ongoing declines. Asking and auction values are showing mixed trends, with some categories experiencing increased asking prices while others face significant decreases.

For Complete Reports

For further information or to obtain detailed analyses from Sandhills Global, please contact us at [email protected].